Why I Bought a Fraction of a $3M Villa in Costa Rica (And Made 12% ROI in Year One)

1. Introduction

Imagine owning a share of a stunning $3 million villa in Costa Rica—where jungle meets beach, and sunsets paint the sky—without the full cost and responsibility. That’s exactly what I did by purchasing a fractional ownership share, and to my surprise, I earned 12 % ROI in the first year. In this article, I’ll walk you through how fractional ownership works, why Costa Rica is such a compelling destination, and how a well-structured fractional deal can deliver both luxury living and solid returns.

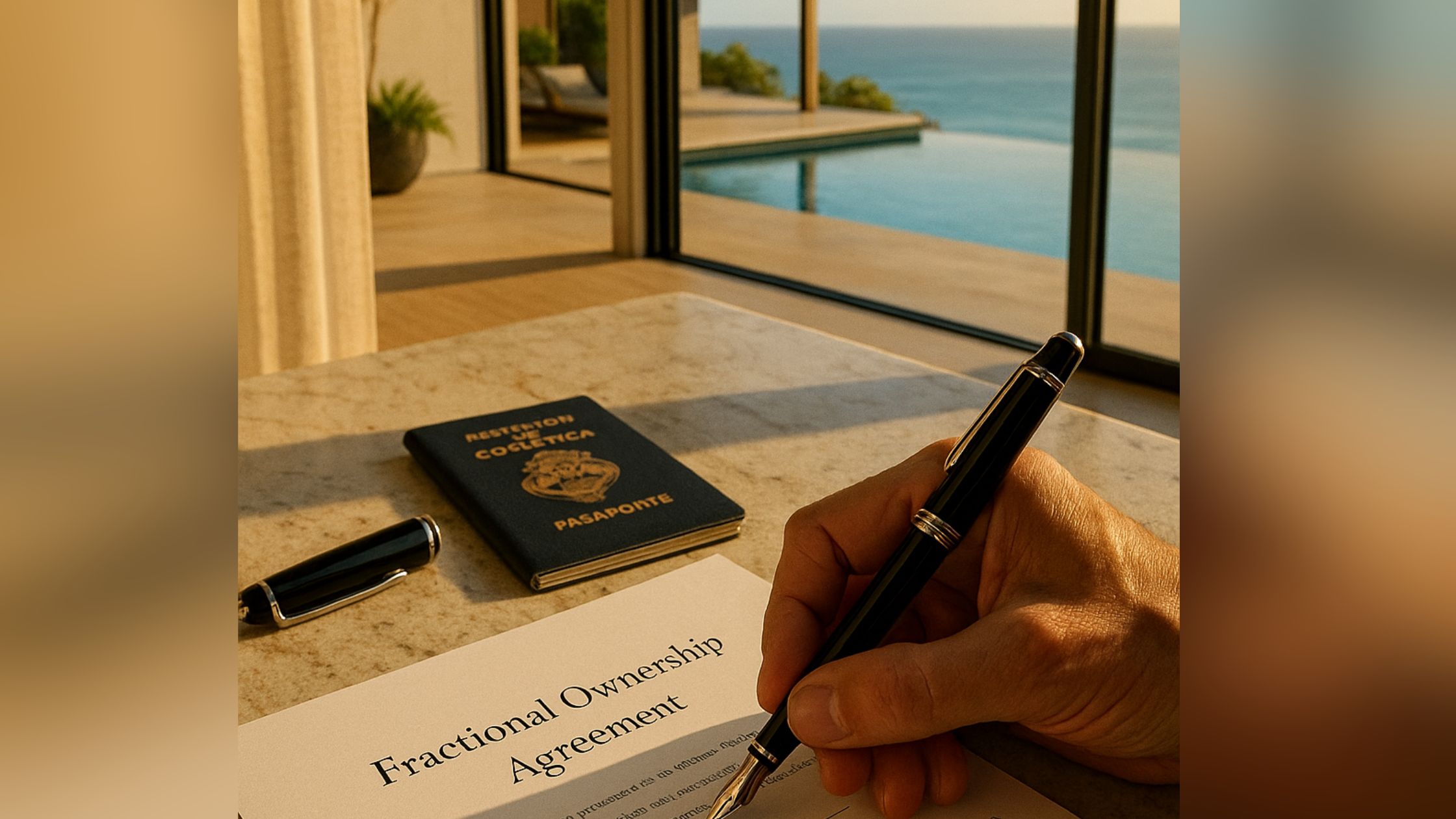

2. What Is Fractional Ownership?

Fractional ownership lets multiple investors hold legally deeded equity in a high-value property, splitting costs, management, and usage rights. Unlike a timeshare—where you buy time, not ownership—you’re buying actual real estate, and your share appreciates (or depreciates) with the property.

Each shareholder gets a set number of weeks per year to use the property and participates in rental income when the villa isn’t in use. A professional manager typically handles bookings, upkeep, and guest services, funded by management fees split among owners. You also share operating expenses, ensuring affordability without sacrificing quality or financial transparency.

There are several models of fractional ownership—from branded residence clubs to standalone private homes in joint ownership structures.

3. Why Costa Rica?

Strong Legal Framework

Foreigners can own titled property in Costa Rica outright, with the exception of certain beachfront concession zones. The legal structure allows for straightforward fractional ownership through corporations, trusts, or co-titled deeds.

Robust Tourism Growth

Tourism in Costa Rica is booming. Demand for eco-luxury, digital nomad destinations, and boutique villas has spurred consistent growth in short-term rental markets. Locations like Tamarindo, Nosara, and Santa Teresa have seen rising occupancy and average nightly rates. This makes Costa Rica one of the few international markets where it’s still possible to find double-digit rental ROI.

Luxury + Lifestyle Appeal

Costa Rica is not just an investment—it’s a lifestyle play. As an owner, I’m able to enjoy weeks in a high-end villa each year, while the rest of the time it’s rented out to affluent travelers. It’s the best of both worlds: passive income and unforgettable personal use in one of the world’s most desirable tropical destinations.

4. Examples of Fractional Ownership Programs

To illustrate how this works in the real world, here are some notable fractional ownership offerings in Costa Rica:

- The ARK in Santa Teresa

A regenerative luxury village offering co-ownership opportunities with flexible usage, full-service management, and a strong rental model where owners receive the majority of rental income. - Jungle Villas by Belong Costa Rica

Experiential properties in Arenal and Manuel Antonio designed for the short-term rental market. These offer double-digit projected returns, along with personal usage benefits and property management included. - Ocotalito Resort & Spa (Lake Arenal region)

High-end villas with shares starting at around $140,000 for 6-week allocations. The properties come with hotel-style amenities and are structured for passive investor participation.

Each of these operates under a professional management umbrella, ensuring booking systems, maintenance, and owner communication are all handled efficiently. They’re also positioned in high-demand tourism areas with proven rental demand.

5. How I Made 12% ROI in Year One

Here’s how a realistic 12% return came together in the first year:

- Rental Income (10–14%)

The villa was listed on short-term rental platforms targeting luxury travelers. With high occupancy during peak season and premium nightly rates, the gross rental income alone was strong enough to hit double-digit returns. - Fixed Pre-Construction Returns

Because I bought in during an early phase of the project, I received a guaranteed return (paid quarterly) while the property was being completed. That alone covered nearly 8% of the total investment in year one. - Efficient Cost Structure

After expenses—including property management, cleaning fees, and maintenance reserves—my net income landed just above 12% of my original buy-in. The returns were tracked transparently via monthly reporting. - Potential Appreciation Upside

Although not included in the year-one ROI calculation, market value for properties in this area rose significantly. If I were to sell my share today, I’d likely earn an additional 10–15% on capital appreciation.

6. Risks & Considerations

As promising as it is, fractional real estate investing is not without risks. Here are the key ones I evaluated:

- Overpriced Shares

Some programs inflate the share cost far beyond the fair market value of the villa. Always compare the total valuation against comparable properties in the same region. - Legal Complexity

Not all ownership structures are created equal. Some offer deeded ownership, while others use corporate shares or trusts. It’s crucial to engage a local attorney to verify titles, zoning, and land-use rights. - Liquidity Constraints

Reselling your fractional share may not be as straightforward as selling a full property. There’s often no open market, so you’re dependent on private buyer interest or program-specific resale systems. - Shared Usage Conflicts

If the ownership model isn’t clearly defined, disagreements over peak season usage, guest access, or maintenance timing can become problematic. - Infrastructure Gaps

Some areas of Costa Rica—especially emerging destinations—have limited access to paved roads, reliable electricity, or internet. Ensure your investment includes contingency solutions for these issues.

7. Step-by-Step: How I Did It

Here’s a breakdown of the exact approach I used—from research to rental management:

- Market Research & Site Selection

I evaluated top destinations—Tamarindo, Nosara, Papagayo, Arenal—using rental performance data and tourism trends. I zeroed in on a beachfront-adjacent villa with projected rental returns above 12%, partially backed by fixed returns during development. - Choosing the Right Program

After vetting options like Nikori, Belong, and The ARK, I selected a developer offering deeded ownership in a Cayman-incorporated entity, deeded land title, guaranteed pre-construction returns, and hospitality-grade management. - Legal Setup & Due Diligence

I hired a Costa Rican lawyer to run a title search and confirm zoning and corporate structures. We used a dedicated limited liability company (SRL) to hold the title, avoiding shared liabilities. - Financing & Structuring the Investment

By funding the investment through personal cash, I avoided high loan costs. My investment exceeded the USD 150,000 residency threshold, so I filed for Investor Residency—an added lifestyle bonus. - Booking & Rental Management

A local property manager handled marketing, online listings, guest vetting, cleaning, inspections, and monthly financial reporting. I reserved four blocks of time quarterly for personal use, allocating them through a rotating calendar.

8. Is It Right for You?

Fractional real estate investing in Costa Rica typically suits:

- Lifestyle investors who want personal vacation time in luxury villas.

- Professionals with 50k+50k+50k+ liquid funds, but who prefer not to shell out full purchase price.

- Hands-off investors who rely on local management rather than self-managing.

- Those seeking global asset diversification, often tied with U.S. or European portfolios.

Be aware that this path is not ideal if:

- You want full control—renovations, scheduling, or resale.

- You need immediate liquidity; fractional shares can take months or years to resell.

- You’re risk-averse with emerging-market laws or weather infrastructure.

9. Conclusion

My investment in a fractional share of a $3 million Costa Rican villa delivered a 12% net ROI in the first year through a blend of guaranteed development-phase returns, strong rental yield, and careful cost control. With deeded ownership, professional management, and vacation access, this model elegantly balances luxury lifestyle with solid investment performance.