5 Credit Cards That Give You First-Class Flights and 5-Star Hotels for Free (Almost)

Imagine boarding a first-class cabin, sipping champagne, and gazing out over the clouds—without paying for a ticket. Picture checking into a luxurious 5-star suite… for almost free. Thanks to credit-card sign-up bonuses, travel credits, and savvy points transfers, this dream is entirely within reach.

When we say “free (almost),” here’s what we really mean:

- You pay the card’s annual fee (ranging from $95 to $795).

- You meet minimum spend requirements within the card’s offer window.

- You use points strategically, often transferring them to airline or hotel partners.

The upfront investment—both fee and spending—is quickly recouped when you redeem points for premium flights or luxe hotel stays. Used correctly, these cards offer exceptional value and turn everyday purchases into unforgettable experiences.

What Makes a Credit Card Ideal for Luxury Travel

Before we dive into the top five cards, let’s unpack why certain features matter:

1. High-Value Welcome Bonuses

- Top-tier cards often offer bonus bundles worth $1,000–$3,000+ in travel.

- American Express Platinum, for example, currently offers up to 175,000 Membership Rewards points—often valued at ~$3,850.

- Chase Sapphire Reserve has a 100,000-point bonus plus a $500 travel credit.

2. Transfer Partners for Maximum Value

- Travel cards often allow point transfers to airline and hotel loyalty programs.

- Examples: Amex → ANA, Emirates; Chase → United, Hyatt; Capital One → Emirates, Etihad.

- This flexibility enables booking premium cabins or suites at a fraction of cash prices.

3. Luxury Travel & Hotel Perks

- Cards come with perks like lounge access, elite status, and credits.

- Amex Platinum: Centurion/Delta lounges, hotel credits

- Chase Reserve: Club and Priority Pass lounges, travel insurance

- Venture X: airport lounge access + $300 credit

4. Travel Protections

- Insurance benefits like trip cancellation, baggage delay, and rental coverage are essential.

- Chase Reserve offers up to $10,000 trip cancellation and $100 baggage delay reimbursement.

5. Annual Fee vs. Benefits

- Premium cards generally charge high fees ($395–$795).

- But when fully utilized, credits and perks frequently outweigh the cost.

The 5 Credit Cards That Can Unlock First-Class Flights & 5-Star Hotels

1. The Platinum Card® from American Express

- Welcome Bonus: Up to 175,000 Membership Rewards® points after spending $8,000 in the first six months—one of the most generous offers available as of 2025.

- Annual Fee: $695 (personal card).

- Premium Perks:

- Access to the Global Lounge Collection—including Centurion, Delta Sky Club, Priority Pass, Escape, Lufthansa, and Plaza Premium lounges.

- Up to $200 in Fine Hotels + Resorts or Hotel Collection credits annually.

- Monthly digital entertainment credits (Hulu, Disney+, Peacock, Wall Street Journal, etc.) adding up to $240/year.

- $199 CLEAR credit and up to $200 airline incidentals credit.

- Value for Luxury Travel:

- Membership Rewards points transfer to top airline and hotel partners like ANA, Emirates, Virgin Atlantic, Hilton, and Hyatt—often unlocking business- and first-class travel.

- Valuation: ~1.7–2.2 cents/point (Upgraded Points and One Mile at a Time), translating to $2,975–$3,850 for a 175K bonus.

- Bottom Line: High fee, but unmatched perks and a massive welcome bonus make it a top luxury travel card—especially when leveraged for lounges, elite status, and travel credits.

2. Chase Sapphire Reserve®

- Welcome Bonus: 100,000 Ultimate Rewards® points + $500 in travel credit after spending $5,000 in the first 3 months. TPG values this at approximately $2,550.

- Annual Fee: Recently increased from $550 to $795 effective June 23, 2025

- Premium Perks:

- $300 annual travel credit (automatically applied to travel purchases).

- Complimentary Priority Pass and Chase Sapphire Lounges access .

- Up to $120 Global Entry/TSA PreCheck credit every four years.

- Strong travel protections including trip cancellation/interruption and baggage delay coverage.

- Value for Luxury Travel:

- Ultimate Rewards points transfer 1:1 to top partners like United, Hyatt, and Emirates, unlocking high-value redemptions.

- Bottom Line: Offers excellent flexibility, premium perks, and, with strategic use, can easily offset the high annual fee.

3. Capital One Venture X Rewards Credit Card

- Welcome Bonus: 75,000 miles after spending $4,000 in three months. Valued at ~$750 in travel or higher via partner transfers.

- Annual Fee: $395.

- Premium Perks:

- $300 annual travel credit on Capital One Travel purchases.

- 10,000-mile bonus each anniversary (~$100 travel value).

- Unlimited access to Capital One Lounges and Priority Pass.

- $120 Global Entry/TSA PreCheck credit every four years.

- Value for Luxury Travel:

- Miles transfer to premium carriers like Emirates, Etihad, and Air France–KLM.

- Earns 10x on Capital One Travel bookings and 5x on other travel.

- Bottom Line: Excellent mid-tier premium card with strong transfers and perks, outperforming its modest fee.

4. Chase World of Hyatt Credit Card

- Welcome Bonus: Typically 30,000–60,000 Hyatt points. Even at entry, enough for several nights at top-tier Hyatt resorts.

- Annual Fee: $95 .

- Premium Perks:

- Discoverist elite status (upgradable through spend).

- Annual free night award at Category 1–4 properties.

- Earn 4x on Hyatt stays, 2x on travel and dining.

- Value for Luxury Travel:

- Hyatt points are widely considered among the most valuable hotel currencies (1.5–2.5 cents/point).

- Annual free night award can offset the fee many times over.

- Bottom Line: Best low-fee hotel card focused on premium stays—especially for Hyatt loyalists.

5. Marriott Bonvoy Brilliant® American Express® Card

- Welcome Bonus: Up to 95,000 Bonvoy points (varies).

- Annual Fee: $650 .

- Premium Perks:

- Free night award (up to 85,000 points) each year.

- Gold Elite status + $300 annual dining credit at Marriott properties.

- 6x on Marriott spend, 3x on airfare and dining.

- Value for Luxury Travel:

- Marriott award pricing means up to Category 8 nights—great value when using free night and bonus points.

- Bottom Line: If you consistently stay at Marriott or Aspire to high-end brands, this card delivers significant annual return relative to its fee.

These five cards each bring a unique blend of generous welcome bonuses, transferability, and luxury travel perks—from lounge access and elite status to travel credits and award night certificates. When used thoughtfully, they can unlock high-value premium cabin flights and lavish hotel stays that render the annual fees nearly irrelevant.

How to Maximize These Cards for Near‑Free Luxury Travel

- Set Clear Travel Goals & Track Points Across Cards

Define your dream trips—whether that’s an international first-class flight or a suite upgrade. Use tools like AwardWallet to monitor multiple loyalty balances and never overlook points before they expire. - Earn More with Everyday Spending and Bonuses

Leverage bonus categories: 5× points on travel with Amex Platinum and Venture X; 4× Hyatt stays with the Chase World of Hyatt; 6× Marriott spending on the Marriott Brilliant Card. Don’t forget to use shopping portals (e.g., Capital One or Amex Offers) for extra points—sometimes earning 10× or more per dollar . - Strategic Transfers: Only When You Have the Award Booked

Transfer points only after confirming award availability. For example, transferring Chase points to United for business class to Japan during ANA sales delivers outsized value—but only if space is confirmed. - Maximize Free Night Certificates

Use them at aspirational properties—e.g., Waldorf Astoria Maldives or Conrad Bora Bora—where cash rates far exceed certificate value. Avoid using them at low-tier properties, where they’re better used elsewhere. - Book Premium Flights & Hotel Stays During Peak Worth

Premium cabins and luxury hotels often spike in price during holidays—use your points then for maximum return (often 2–5 cents per point). - Combine Card Perks

For instance, use your Venture X’s $300 travel credit to cover part of your hotel, transfer Venture X points to Hyatt for resort bookings, then pay with your World of Hyatt card to earn 4× points. - Pay in Full and Monitor Your Statements

Never carry a balance—interest negates the value of rewards. Keep an eye on statements to ensure you’re hitting bonuses and credits.

Realistic “Free” Luxury Scenarios

- First-Class Emirates to Europe

• Sign up for Amex Platinum (175K MR points).

• Transfer 140K to Emirates Skywards for one-way first-class to Milan (~$12K value).

• Use another 35K back to start building toward a return or hotel stay. - 3-Night Stay at Park Hyatt Paris Vendôme

• Use Welcome bonus from Chase Sapphire Reserve + Venture X.

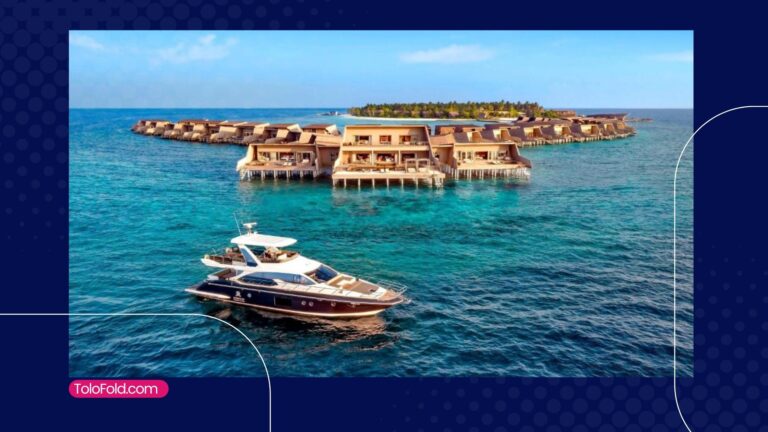

• Transfer 70K Chase Ultimate Rewards to Hyatt—enough for 3 nights at 5-star Park Hyatt (~€600/night cash value). - Annual Free Night at Waldorf Astoria Maldives

• Use Marriott Bonvoy Brilliant’s annual 85K free night certificate for 1 night (~$2,000 value).

• Book additional nights via points earned on Marriott stays at 6× per dollar. - Global Lounge Hopper Trip

• Book a route with premium cabin segments via Amex/MR transfer partners.

• Enjoy Amex Centurion lounges, then Emirates lounge in DXB, and Priority Pass lounges—all included via Amex Platinum and Chase Sapphire Reserve.

With shrewd use of sign-up bonuses, points transfers, and card perks, you can experience first-class flights and ultra-luxury hotel stays for the equivalent of a moderate annual fee—earning back two to five times what you invest.

- Choose one premium card, meet the minimum spend, and begin stacking transfers.

- Uplevel by adding co-branded or mid-fee cards and using credits annually.

- Always book smart: verify award availability before transfer, track certificates, and never carry a balance.

These aren’t theoretical schemes—they’re proven strategies backed by real-world value. Ready to elevate your travel?